Australian workers are doing it tough, and one of the fastest-growing expenses is insurance.

The insurance industry is eye-wateringly profitable – and those profits just keep growing – rain, hail or shine. Unsurprisingly, so do customers’ premiums, almost like clockwork.

Insurance costs affect everyone – from car and home and contents insurance, to health, business and pet insurance.

Continuing the important work that began with the Inquiry into Price Gouging and Unfair Pricing Practices, union members are honing in on the insurance industry.

Insurance premiums are skyrocketing

We know that insurance costs flow through the entire economy, worsening inflation.

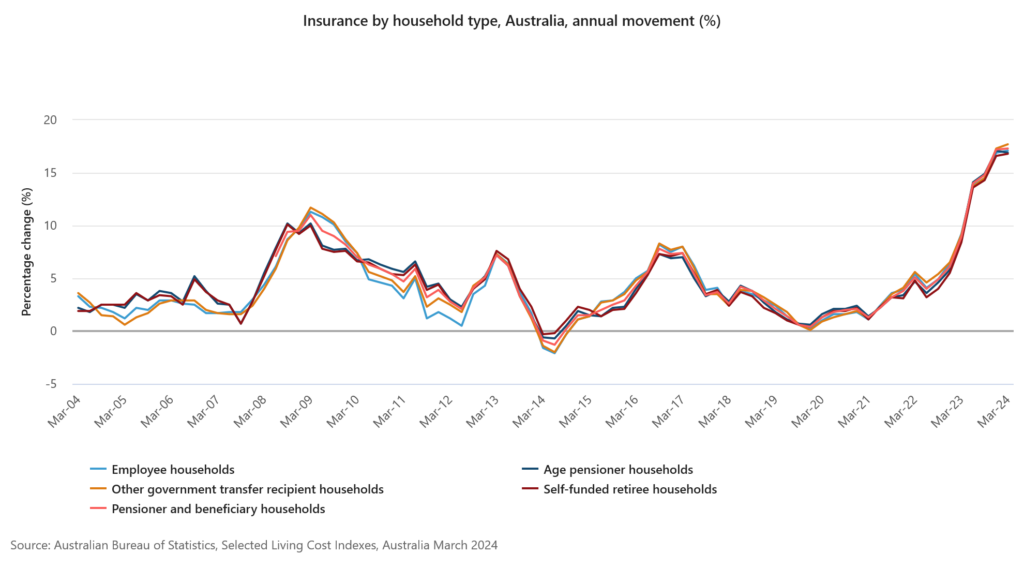

According to the Australian Bureau of Statistics (ABS), premiums for home and motor insurance increased by an average of 16.2 per cent in 2023.

The graph below speaks for itself.

In addition, the Inquiry into Price Gouging discovered that between:

Between March 2021 and September 2023, insurance prices rose 22.6 per cent. This compares to growth of 47.1 per cent between December 2009 and December 2019, meaning the price of insurance has grown just shy of half again in the last two and a half years what it had grown in the ten years prior to the pandemic.

Inquiry into Price Gouging and Unfair Pricing Practices, full report

Accelerating premiums a key driver of inflation

As insurance premiums increase rapidly, the effects are felt across the economy, as prices everywhere increase.

For instance your local small business, forced to pay higher insurance premiums, naturally need to pass costs onto customers.

Another phenomenon is that more and more people, particularly in bushfire and flood-prone areas, are unable to afford essential insurance products like home insurance – leaving them financially exposed if the worst is to happen.

The insurance industry, and its decisions to increase premiums massively to secure record profits, deserves scrutiny.

The tactics insurance companies use to maximise profits

Here are just a few of the tactics that insurance companies use to put the squeeze on customers and drive up their profits:

Excuse-flation

Otherwise known as ‘greedflation’, this is a common one we’re all too familiar with in recent years coming out of the global Covid-19 pandemic and Russia’s ongoing invasion of Ukraine, where general inflation provides camouflage for businesses to raise prices without justification.

The trick to it is, when inflation begins to fall and global pressures ease, insurance companies still don’t cut their prices.

Loyalty taxes

Loyalty taxes are endemic in the insurance industry.

Insurance companies set their sign-up prices low to attract new customers, then sharply increase them in subsequent years – making it difficult for existing customers to know how much their premiums are going up year on year.

Algorithmic pricing

Algorithmic pricing is also common in insurance, where computer algorithms set premiums automatically, taking into account competitor prices, raising issues around whether this reduces price competition and is analogous to cartel pricing.

Case studies in greed

We’ve seen numerous examples in recent history of insurance companies unfairly hiking prices, and using these and other shady tactics to record record-breaking corporate profits.

Insurance Australia Group (IAG), which owns a range of brands including NRMA, CGU, RACV and SGIO, recorded a net profit after tax of $407 million for the six months to December 31, 2023.

IAG’s net profit is up 276% for the first half of 2024, with premium revenue increasing by 12.5%.

In 2023, QBE, another major insurer, increased its annual net profit by 131%, from US$587 million ($884 million) in 2022 to US$1.36 billion ($2.1 billion).

Holding insurance companies to account for price gouging

It was a union-led campaign that brought about the Inquiry into Price Gouging and Unfair Pricing Practices, and again it is union members who are holding big business to account during this cost-of-living crisis.

We want to hear from you: have you experienced unexplained increases to your premiums? Or been caught by unfair price gouging tactics?

SHARE:

Report a rip-off: price gouging in the insurance industry